Aspen West, CFP®

Wealth CFO

Navigating The Path To True Wealth Is Clearer With Expert Advice.

My passion is empowering clients to realize their full potential. I begin by listening deeply, understanding their unique definition of ‘True Wealth,’ and placing their life goals at the heart of our conversations. With honesty and a tailored approach, I craft comprehensive financial strategies that accelerate their journey towards their vision. I’m here to celebrate their successes and provide unwavering support, ensuring they stay on track.

Backed by a decade of industry experience and the CERTIFIED FINANCIAL PLANNER™ (CFP®) designation, I offer expert guidance to navigate today’s complex financial landscape. I specialize in serving entrepreneurs, particularly trades companies and women-owned businesses, as well as families seeking to secure their children’s financial future.

CLIENTS WE SERVE

Empowered Women

Business

Owners

Families

Gen X/Y

Our Tool Box

Integrated Financial Planning & Investment

Management Services

Budget/Cash Flow Planning

Employee Benefits Optimization

Goals-Based Planning

Tax Optimization

Retirement Planning

Divorce Planning

Risk Management

Divorce Mediation

Education Planning

Estate Planning

Debt Management

Investment Management

How We Serve and Advise You

Empowering Your True Wealth

Financial Assessments

Who it’s for:

- Hour Get Organized Meeting

- 1 Financial Roadmap Meeting

- Financial Roadmap with list of recommendations

- AssetMap w/ financial health Signals

- Ongoing access to our Forefront Client Dashboard to monitor your finances

This is not an ongoing engagement.

Foundational Wealth

Who it’s for:

- Single or married taxpayer(s)

- W-2 employee or self-employed

- Under $500k/year income

- Best for those already in the building years of their wealth journey that want ongoing engaging to accelerate True Wealth

Personal Family CFO

Who it’s for:

- Single or married taxpayer(s)

- Executives, Tech Professionals, or Consultants

- Over $500,000/year income or have significant equity compensation or already retired with a net worth above $2 million

- Best for those looking to address estate planning, advanced investment strategies, risk management, charitable planning, or creative tax strategies

What it includes:

- Introductions to CPA’s in our network

- Tax Projections and Advanced Tax Planning annually

- Ongoing collaboration with your professional team your, CPA and attorneys

Are You Confused About Your Financial

Life? We Can Help.

Navigating important financial decisions in your life can be a tricky task. There are often too many options to choose from, too much conflicting information, and too many confusing rules. We help you cut through the noise and make carving your own path to financial independence simple, fun, and anxiety-free.

To many options

to choose from

To much

conflicting info

To many

confusing rules

You’ll Build True Wealth Intentionally with Passion, Consistency, and Our Guidance

What Can You Expect

Working With Us?

A successful working relationship with a wealth advisor is built entirely on trust and total freedom to be completely honest, open, and humble with each other. We create a completely judgment-free zone, and while we take the work we do incredibly seriously, we also want our time together to be fun and enjoyable. It’s very exciting and rewarding when great progress is made and goals are accomplished!

An Overview of Our Planning Process

Expert Financial Advice to Help You Navigate Life’s Major Decisions

Empowering you from the Start and at Every

Curve, Pivot, and Challenge on your Journey

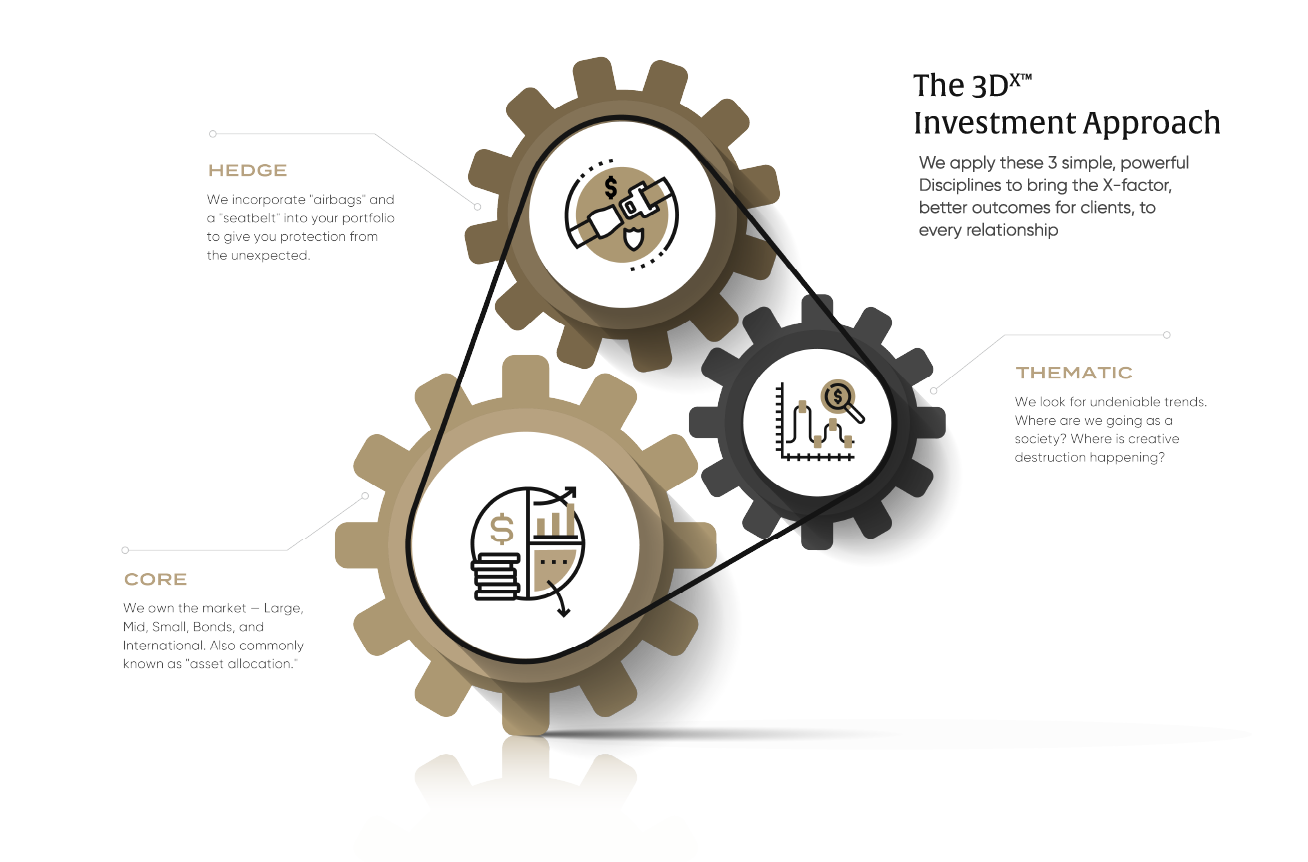

The Forefront Investment Philosophy

Simple, Powerful Approach to Investing

Powerful Insights

The Power of the Dollar-Cost Averaging in a Volatile Market

The Power of Compound Interest

Empowered Women

Secure Act 2.0 Notes and Highlights

The Importance of Exit Planning for Small Business Owners

Ready to Get Started?

Begin the process of connecting with a team to Protect, Grow and sustain significant long term wealth. We will visit with you whereever it is convenient, whether that be your home, our offices or over a zoom meeting.