Eric J. Negron, CEPA

CEO | Wealth CFO | Exit Planner

Meet our CEO | Wealth CFO | Exit Planner

Eric Negron is the CEO of Forefront, leading a talented team of Financial Advisors, Wealth Planners, Tax Attorneys, Divorce Planners, and Insurance Advisors: All on a mission to become their client’s Second ThoughtTM, Serving clients and their families while building a lifetime bond that provides True Wealth and Freedom for generations.

Eric is passionate about elevating the advisor community through the Financial Advisor Group (FAN) and the David Advisor Movement (DAM) which gathers growth-minded individuals on to a platform where they collaborate, share industry insights, provide masterclasses and networking

PROFESSIONAL

CLIENTS WE SERVE

Family Held Businesses

Business Owners

Tech

Executives

Families

Empowered

Women

AUTHORITY

Certified Exit Planning Designation

Accredited Wealth

Management Advisor

Masters in Financial Planning –

Student

Host of Your Exit Plan

Host of DAM Podcast

Austin 40 Under 40

AFFILIATIONS

Financial Planning Association

Exit Planning Institute

Provisors

Exit Planning Forum

2K+

Clients Served

98%

Retention

Rate

10+

Average Client

Tenure (YEARS)

Learn From Eric on These

Podcasts and Insights

Our Tool Box

Integrated Financial Planning & Investment

Management Services

Budget/Cash Flow Planning

Employee Benefits Optimization

Goals-Based Planning

Tax Optimization

Retirement Planning

Divorce Planning

Risk Management

Divorce Mediation

Education Planning

Estate Planning

Debt Management

Investment Management

The Forefront Team

A Collection of Thinkers, Learners, and Problem Solvers

Eric Negron, CEPA, AWMA

CEO | MANAGING PARTNER

Amy Colton, MBA, CDFA

PRESIDENT OF DIVORCE MADE SIMPLE | WEALTH ADVISOR

Chad Rixse, CRPS®

DIRECTOR OF FINANCIAL PLANNING | WEALTH ADVISOR

Jennifer Varteressian

COO | DIRECTOR OF TAX RESEARCH | TAX ATTORNEY

Nick Wolf, CFP, CEPA

EXIT PLANNER | WEALTH CFO

Christopher Marrone, CFP

WEALTH ADVISOR

Michelle Fuccella

FINANCIAL PLANNING ANALYST

Lauren Mulligan

CLIENT SERVICE DIRECTOR

Kennedy Alleva

Marketing DIRECTOR

Debra Bigler

DIRECTOR OF BUSINESS DEVELOPMENT

Christopher Amores, MPA

CHIEF TECHNOLOGY OFFICER

Happy Witt

Billing Operations Associate

How We Serve and Advise You

Empowering Your True Wealth

Business Wealth CFO

Who it’s for:

- Single or married taxpayer(s)

- Self-employed, small Business Owner, Family Held Business Owner

- Over $750,000/year in take home income or Business revenue above $3 million

- Best for entrepreneurs or business owners looking to address, buy-sell agreements, create an owners board of directors, address advanced business planning strategies, risk management, and creative tax planning

What it includes:

- Personal tax return preparation up to $1800 a year with a CPA in our network

- Includes and annual business valuation done by a CPA/Certified Business Value Appraiser

- Estate Plan Summary for each owner up to 4

- Ongoing collaboration with your professional team and an Annual Wealth Summit with your, CPA and attorneys

Personal Family CFO

Who it’s for:

- Single or married taxpayer(s)

- Executives, Tech Professionals, or Consultants

- Over $500,000/year income or have significant equity compensation or already retired with a net worth above $2 million

- Best for those looking to address estate planning, advanced investment strategies, risk management, charitable planning, or creative tax strategies

What it includes:

- Introductions to CPA’s in our network

- Tax Projections and Advanced Tax Planning annually

- Ongoing collaboration with your professional team your, CPA and attorneys

You’ll Build True Wealth Intentionally with Passion, Consistency, and Our Guidance

What Can You Expect

Working With Us?

A successful working relationship with a wealth advisor is built entirely on trust and total freedom to be completely honest, open, and humble with each other. We create a completely judgment-free zone, and while we take the work we do incredibly seriously, we also want our time together to be fun and enjoyable. It’s very exciting and rewarding when great progress is made and goals are accomplished!

INSIGHTS SEEN IN:

An Overview of Our Planning Process

Expert Financial Advice to Help You Navigate Life’s Major Decisions

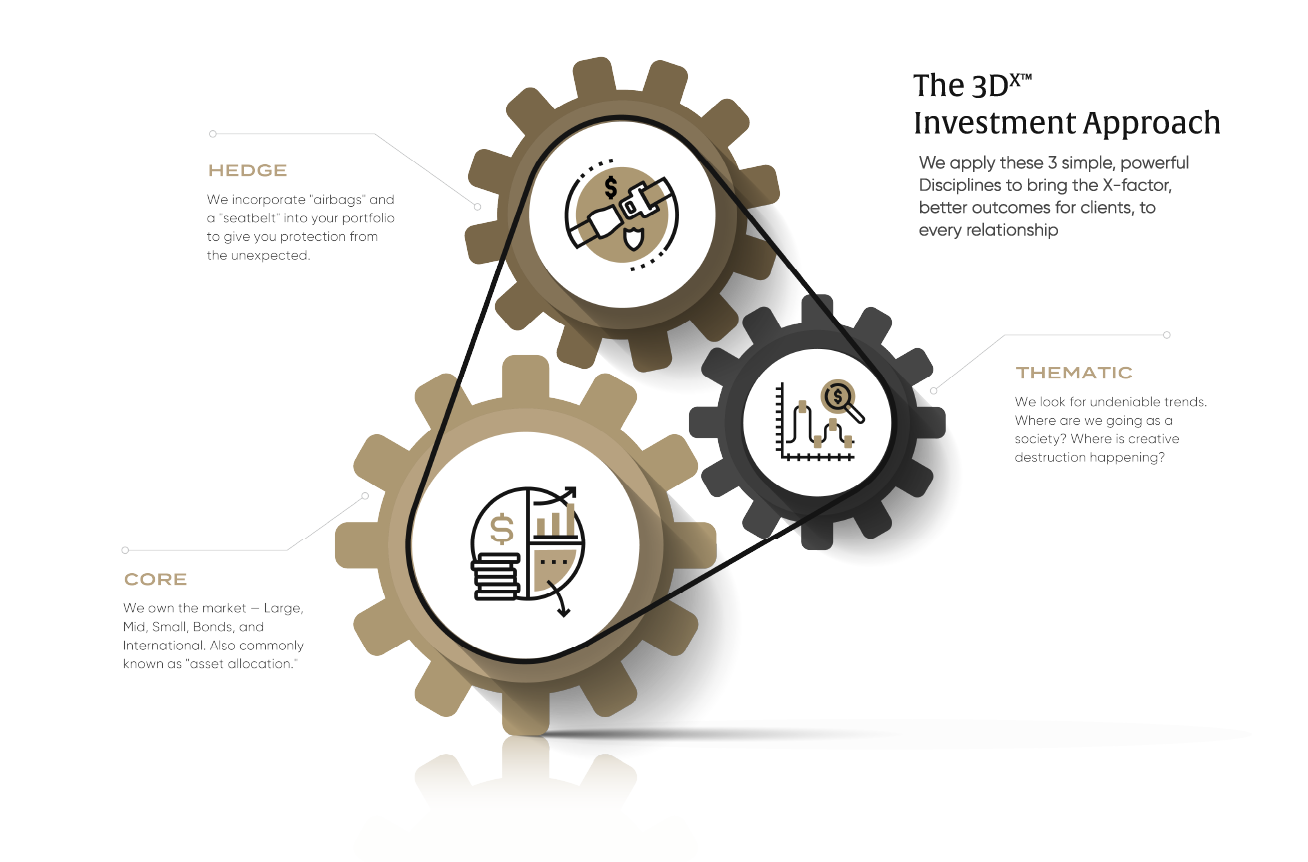

The Forefront Investment Philosophy

Simple, Powerful Approach to Investing

Powerful Insights

The Power of the Dollar-Cost Averaging in a Volatile Market

The Importance of Exit Planning for Small Business Owners

The Corporate Transparency Act

Secure Act 2.0 Notes and Highlights

Ready to Get Started?

Begin the process of connecting with a team to Protect, Grow and sustain significant long term wealth. We will visit with you whereever it is convenient, whether that be your home, our offices or over a zoom meeting.