Inside the Silicon Valley Bank Collapse and How You Can Protect Your Cash

The recent collapse of Silicon Valley Bank and Signature Bank has led the banking industry and consumers into protection mode with raised concerns over a larger potential banking crisis and the possible domino effect of the collapse. While the U.S. federal government has officially stepped in and stated they’ll do whatever necessary to maintain stability among banking institutions, including insuring 100% of all deposits made with Silicon Valley Bank with FDIC funds, many remain worried about the safety of their own deposits and the potential further repercussions from this recent meltdown. Despite all the alarm-raising in the media, however, the banking industry as a whole still remains very stable, and it’s important to cut through the noise and look at the facts and data to understand what’s truly going on.

This blog seeks to dive deeper into the causes of the recent banking collapses, examine the implications of the federal government’s intervention, and provide clarity on what depositors can do to protect themselves and the assets they hold in banks . While it’s important to acknowledge the valid concerns and worries surrounding this issue, it’s also crucial to approach it with a level head and a full understanding of the situation at hand. So, let’s take a closer look and separate facts from fiction.

How the Silicon Valley Bank collapse occurred

There were a number of factors at play that, all combined, created the perfect storm for the SVB collapse.

For one, technology stocks were hit particularly hard when the Fed began raising interest rates in early 2022 in order to combat the inflation caused by a dramatic increase in the money supply during the pandemic. The higher costs of borrowing (something tech companies have historically heavily relied on for growth) and the higher costs of goods and services from inflation became particularly tough for tech companies to weather, so layoffs ensued, and stock prices tumbled.

Secondly, SVB just so happened to sit in the center of the technology start-up universe as both a deposit institution and lender with most of its primary customer base being tech start-ups and other tech-centric companies. As technology stocks fell and venture capital funding dried up, increasingly cash-strapped and unprofitable technology startups started defaulting on loans and had to start tapping their deposits, which were often deposited with SVB. At first, this wasn’t much of an issue, but as the speed of withdrawals picked up, SVB had to start selling the investments and assets that were made with depositor funds.

It’s very common and a normal course of action for banks to make investments with depositor funds. The problem with SVB, however, was that these investments were made into higher-risk mortgage securities in the search for higher yield.

However, when interest rates started rising, those bond prices fell (read more on the inverse relationship between bond prices and interest rates here), and SVB had to sell their holdings for substantial losses.

This conundrum led SVB to become insolvent and made depositors fear their funds wouldn’t be protected, a classic run on the bank ensued, and SVB collapsed. At that point, bank regulators had no choice but to step in and seize SVB’s assets in order to stem the bleeding and protect the assets still remaining at the bank.

Understanding the real repercussions

The biggest concern for most people is the ripple effect of SVB’s collapse and potential runs on other banks that don’t have enough liquidity to cover. These fears have prompted intense discussion around fractional reserves and liquidity coverage ratios (LCRs) at other banks. And rightfully so, because at the core of SVB’s collapse was a lack of liquid assets to cover depositor withdrawals when the run on the bank occurred.

The truth is, a lot of what happened with SVB could’ve been fully prevented. Back in 2018, regulations were rolled back for banks of SVB’s size. After the financial crisis of 2008, then-President Barack Obama signed the well-known Dodd-Frank legislative bill into law that created stricter regulation for banks with at least $50 billion in assets. The law required these banks to undergo an annual Federal Reserve “stress test” to maintain a certain level of capital and liquidity in order to be able to absorb any potential losses and quickly meet cash obligations in addition to filing a “living will” plan for a clean dissolution if the banks did happen to fail.

However, in 2018, President Trump got rid of the $50 billion threshold and made the rules only applicable for banks with at least $250 billion in assets, which comprised only about a dozen banks at the time. While the rollback law still gave the Federal Reserve the right to choose to apply the regulations to particular banks with at least $100 billion in assets, the smaller banks were freed from these restrictions, SVB included, which only had about $40 billion in assets at the time.

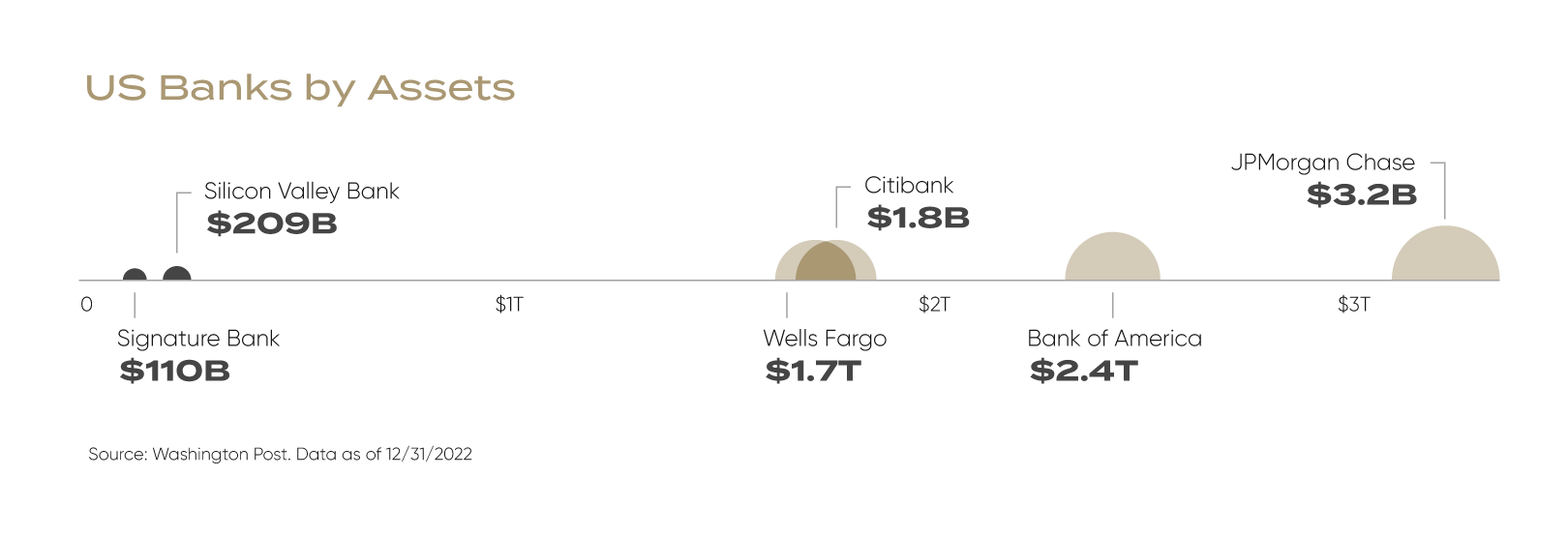

Since these restrictions were no longer in place, smaller banks didn’t have to meet the same liquidity requirements, and some of them, such as SVB, took full advantage as a result. Nonetheless, SVB and the other banks affected are small in the context of the overall banking system. In the chart below, it’s clear how small two failed banks were relative to other, larger financial institutions.

To put this all in context, liquidity can be highlighted as the key takeaway and, more specifically, liquidity coverage ratios of major banks are the real numbers to pay attention to here to understand the general stability of the overall banking system. JPMorgan Chase, for example, which is the largest bank in the United States with more than $3.2 trillion in assets, and is the world’s largest bank by market capitalization as of 2023 has averaged a liquidity coverage ratio of roughly 169%. In other words, at any given moment, JPMorgan Chase has more than enough liqudity to cover its total net cash flow over a 30-day stress period.

Another example is Bank of America. With a market cap of $228 billion and total assets of $3.05 trillion, Bank of America is the second largest bank in the U.S. It’s current liquidity coverage ratio is 120%, which means it’s got high liquidity in the event of a crisis. Approximately 10% of all US bank deposits are held by Bank of America, so it plays a critical role in the entire banking system.

What could happen next?

Clearly, no one has a crystal ball, but regulators were able to step in quickly to fully insure all deposits above the normal $250,000 limit at the two lenders that failed recently. Additionally, on March 16th, 2023, Treasury Secretary Janet Yellen confirmed that Americans should remain confident in the stability of the banking system.

However, it’s also important to know that Yellen also clarified that this is course of action not the norm. Rather, both Silicon Valley Bank and Signature Bank were deemed to have met the “systemic risk exception” to backstop all funds when the FDIC took over and shut down both lenders.

So far, all other banks are acting like normal, even Silicon Valley Bank under FDIC control. If all goes well, these actions will keep the system stable and no additional bleeding will occur, but the largest of banking institutions that dominate the space are also highly liquid and ready to weather a storm if needed, so optimism is a logical conclusion.

Regardless, it’s always a good idea to minimize your own exposure to these types of risks if you regularly keep over $250,000 in cash accounts. Below we cover ways you can protect your cash above the $250,000 threshold.

How you can protect your cash

The first step to protecting your cash over $250,000 is to understand how to get maximum FDIC insurance with one institution.

The FDIC limit is $250,000 per depositor, per insured bank, for each account ownership category, so different account ownerships such as individual accounts, joint accounts, seperate accounts (if married), or through adding beneficiaries or payable-on-deaths to accounts can get you above $250k at one institution. For help in determining your current coverage, try this FDIC EDIE Calculator.

A second way to protect your cash above the $250,000 limit is to utilize a financial institution that offers a “cash management” or network bank account setup. This means that your bank has the ability to spread the funds you have deposited above $250,000 among a network of other banks from a single account. At Forefront we help clients protect their cash through a banking solution like this and through the insured cash management accounts we use at the custodians we work with.

Protect Your Cash and Earn 4%

Insure up to $25 million and earn 4.00% with a Forefront savings account through Stone Castle.

A third way to protect your cash is to invest it in low-risk, high-quality financial products such as money market accounts, CDs, and Treasury securities. These financial products are typically backed by the full faith and credit of the U.S. government and offer a higher level of protection than other investments may. However, it is important to note that past performance is never indicative of future results and no investment is without risk.

It is also important to monitor your bank and investment accounts regularly to ensure that there are no unauthorized transactions or errors. Set up alerts and notifications to be informed of any unusual activity. Keep your login credentials very secure with a good password manager.

Lastly, consider working with a financial advisor who can help you develop a comprehensive plan to protect and grow your wealth. Having a financial advisor in your corner to offer guidance on cash management, risk management, asset allocation, and investment strategies that align with your financial goals and risk tolerance can help you make smarter financial decisions and stay informed.

Let’s Make a Plan to Protect Your Money

Want to learn how Forefront can help you protect your cash above the $250,000 FDIC limits or about what steps you can take to achieve “true wealth” in your life? Schedule a virtual coffee meeting with one of expert advisors today.

Curious to learn more about this topic? Watch a live stream hosted by our CEO, Eric Negron, with a panel of industry experts to hear practical insights on FDIC and protecting your cash.