Mega-Backdoor Roth Guide for High-Income Earners

What is a Mega-Backdoor Roth?

This strategy helps individuals, especially those with high incomes, potentially contribute significantly more to their retirement savings and grow them tax-free. It involves making after-tax contributions to a workplace retirement plan and converting them to a Roth account (Roth IRA or Roth 401(k)).

If available, the strategy can be particularly useful for those who earn too much to contribute directly to a Roth IRA. If you earn $161,000 or more as a single taxpayer or $240,000 or more as a married-filing-jointly taxpayer, then you can’t contribute anything directly to a Roth IRA in the 2024 tax year.

How does a Mega-Backdoor Roth work?

The mega-backdoor Roth strategy allows individuals who can’t contribute directly to a Roth IRA due to income limitations to potentially convert a portion of their retirement savings to a Roth account via two steps. First, you contribute after-tax dollars to your 401(k). These contributions are different from the usual pre-tax or Roth contributions, but they allow you to potentially exceed the annual limit for pre-tax and Roth contributions combined. The key benefit is that while you pay taxes upfront on the contributions themselves, the converted funds and their future earnings grow tax-free in a Roth account, providing tax-free qualified withdrawals in retirement.

The benefits of the Mega-Backdoor Roth Strategy include:

• Increased savings potential: Contribute beyond the standard limit (up to $23,000 in 2024).

• Tax-free growth: Roth contributions grow tax-free in retirement.

• Tax-free qualified distributions: no taxes on qualified distributions in retirement.

The cons of the mega-backdoor Roth strategy include:

• Tax on conversion: You pay income taxes on earnings converted to Roth.

• Plan limitations: Not all plans offer this strategy.

• Complexity: Requires understanding rules and managing rollovers and conversions. formed over the years while also building healthy new ones.

Here are the steps to consider before attempting the strategy:

1. Check plan eligibility: Verify your plan allows after-tax contributions, in-service withdrawals, and Roth conversions.

2. Seek professional advice: Consult a tax and/or financial professional to understand the strategy’s

impact on your situation.

3. Set it up. Make after-tax contributions and periodically roll them over to a Roth IRA or convert

them within your plan (if allowed).

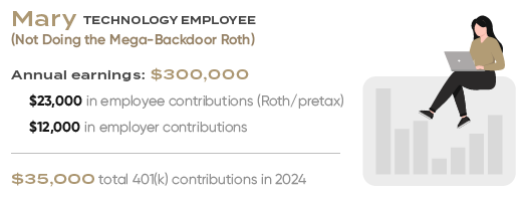

Contribution limits:

• Total contributions (pre-tax, Roth, employer match, after-tax) are capped annually at $69,000 in 2024.

• The available space after pre-tax, Roth, and employer contributions determines the maximum after-tax contribution.

• There are no limits on conversion amounts, but conversions trigger taxes on earnings.

Is the Mega-Backdoor Roth Strategy Worth Doing?

Consider these factors:

• Plan eligibility: Does your company’s 401(k) allow it?

• Financial situation: current savings, retirement goals, other financial needs.

• Tax implications: current and potential future tax rates.

• Complexity: Do you have the time and knowledge to execute the strategy?

One of the biggest reasons for doing a mega-backdoor roth strategy is to help you position more of your retirement savings into “tax-free” accounts. If you consider the following:

• Current United States Budget deficits

• The federal budget is close to 70% focused on social services much of which includes funding social security with 10,000+ baby boomers a day retiring

• Historically low tax rates

All of this emphasizes the need for proper financial planning and having money in different types of retirement accounts,

so there may always be a smart place to pull money from.

If you have questions or would like to review if a Mega Back Door Roth strategy makes sense for you as you plan for an earlier retirement or are doing long-term tax planning. Please use the link below to schedule a meeting with one of our team members today, who would be happy to help answer your questions.

References

Fidelity. (2023, March 24). What is a mega backdoor Roth? | IRA

conversion | Fidelity. Fidelity Investments. Retrieved January 26, 2024,

from https://www.fidelity.com/learning-center/personal-finance/

mega-backdoor-roth

Napoletano, E., & Curry, B. (2023, November 20). What Is A Mega

Backdoor Roth? Forbes. Retrieved January 26, 2024, from https://

www.forbes.com/advisor/retirement/mega-backdoor-roth/

Advisory services are offered through Forefront, a DBA of Forefront Wealth Partners, LLC.

This material is general in nature, was developed for educational use only, and is not intended to provide financial, legal, fiduciary, accounting, or tax advice, nor is it intended to make any recommendations.