Temporary Buydowns: How to Afford a Home in this Market

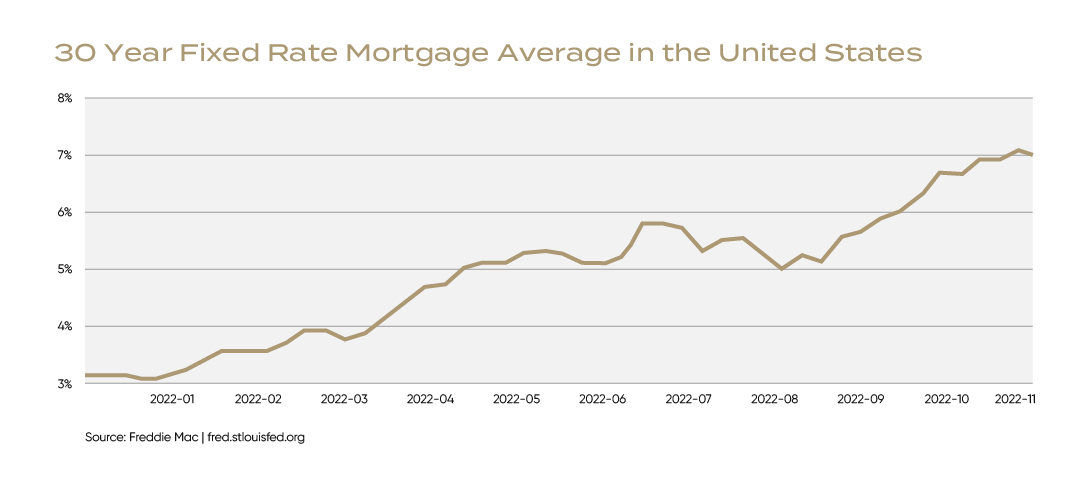

With rates and home prices in flux, many buyers are looking for ways they can successfully navigate this changing market. Between December 2021 and December 2022, the 30-year fixed mortgage interest rate rose from sub-3.000%/year to over 7.000%/year. In that same period, real estate transactions slowed dramatically, and housing inventory tightened even further. This supply and demand issue has led to home prices falling much slower than mortgage rates have risen, which has forced many buyers either out of the market or to rethink their plans entirely.

Home buyers are considering every strategy that can help with their home purchases. One way they’re doing this is through temporary buydowns. With a temporary buydown, the lender, seller, or homebuilder will offer to buy the interest rate on a mortgage down for the first few years of the loan to make it more affordable for the buyer in the beginning.

While a temporary buydown can save you money in the first few years of your mortgage, it’s important to know that temporary buydowns are best for certain scenarios and there are sometimes more effective cost-savings options depending on your current situation and long-term goals. In this article, we cover the ins and outs of temporary buydowns, what scenarios they make the most sense in, and other options to consider in the process.

How Temporary Buydowns Work

A temporary buydown allows borrowers to reduce their monthly mortgage payments for the first one to three years of their loan via a “temporary buydown” of the mortgage’s interest rate. When the loan is taken out, a lump sum of money (sometimes known as a “subsidy”) is deposited into a buydown account, from which a portion is released each month to the loan servicer to reduce the borrower’s payments.

In most cases, a temporary buydown is not something you the borrower will request and pay for yourself. Rather, most buydowns are paid for by either the home builder, seller, or lender in the form of a closing cost and the amount is equal to the total interest savings you’ll receive as the borrower. As we mentioned above, temporary buydowns are most popular in real estate market conditions where transaction volumes are very low, and builders, sellers, and lenders want to entice buyers to make a purchase.

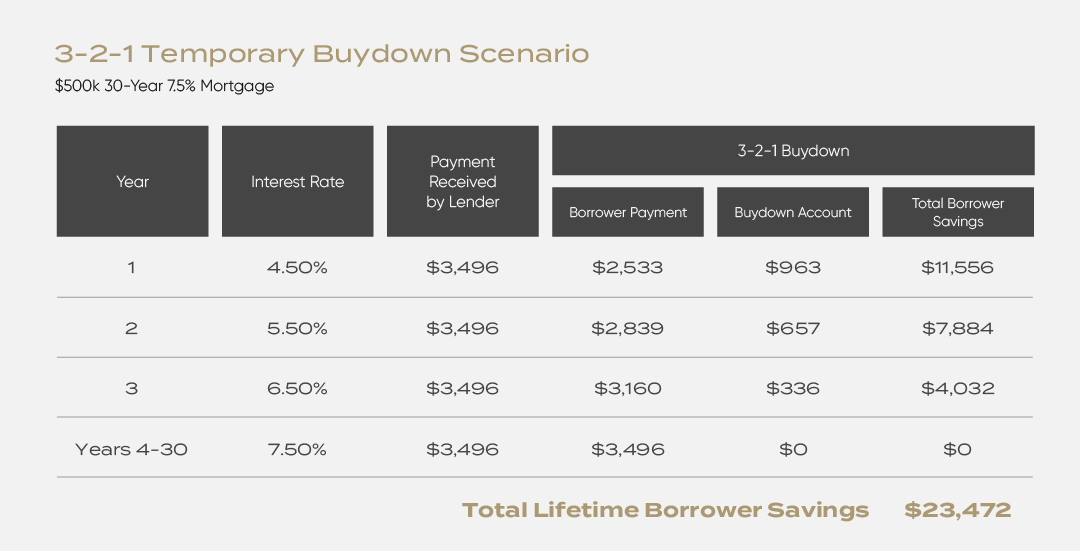

The most common structures you’ll see for a temporary buydown are a “3-2-1”, “2-1”, and a “1-0”. For example, in a “3-2-1”, the rate is bought down 3% from the market rate (that you otherwise qualify for) in the first year of the loan, bought down 2% in the second year of the loan before, and bought down 1% in the third year of the loan before resetting back at the market rate for the remainder of the loan term. See the example below for what this temporary buydown structure might look like:

Make sure to work with a knowledgeable and licensed mortgage professional to see which loan program is going to make the most sense for you.

When Temporary Buydowns Make Sense

Temporary buydowns are generally only available for single-family homes and there may be specific requirements associated with the buydown depending on what type of mortgage you get approved for. Since temporary buydowns provide limited savings over the lifetime of the loan, it’s important to take your whole financial situation and long-term picture into account. Hence, a temporary buydown tends to make sense if:

- You only plan to hold the property for a few years.

- You qualify for a loan at the market interest rate, but you’re worried about your short-term finances or large costs associated with the home in the first few years.

- You expect interest rates to fall within the next one to three years so you can refinance at a lower rate for the remainder of the loan term.

- You expect your income to increase enough by the end of the temporary buydown period to be able to afford the higher monthly payments when the rate resets.

It’s easy to jump at the potential cost savings of a temporary buydown, but first make sure you consider your current financial situation, weigh your goals with the purchase and how they fit into your overall financial plan, and be sure to understand all other potential options before you pull the trigger. As we cover below, there are sometimes better alternatives to temporary buydowns depending on your current situation.

The Major Pitfalls of Temporary Buydowns

As a buyer, there are several potential drawbacks to using a temporary mortgage buydown that is paid for by the seller or lender. First, the buydown will only lower your monthly payments for a limited period of time. After that, the payments will return to their original, higher amount, which could be a financial burden if you are not prepared for the increase. No one has the ability to predict where rates will be in the next few years, so there’s always a risk of not being able to refinance to a lower mortgage rate once the buydown period expires.

Additionally, even though the seller or lender is paying for the buydown, you may still have to put a significant amount of cash down upfront to cover your closing costs and other fees associated with the loan. Furthermore, temporary buydowns may not always be available or may not be even be offered, so it’s possible a temporary buydown may not even be a viable option for you and your particular situation. Finally, temporary buydowns may not offer as much long-term savings as other mortgage options might.

Alternatives to Temporary Buydowns

Depending on your current goals and financial situation, a temporary buydown may not always be the best option for you long-term. For example, if you expect interest rates to keep going up and you’re planning to stay in the home for many years, you may want to explore other options that can translate into greater long-term savings. Some of these options might include:

- Purchasing discount points to permanently buy your rate down. This can make sense if you plan to stay in the home for a long period of time.

- Negotiating the price down on the home purchase to reduce the principal on the loan. This would effectively reduce the total interest paid and put money back in your pocket.

- Negotiating other seller concessions into your real estate transaction to minmize the down payment or other costs you might assume as a result of the purchase.

- Using a VA loan (if you’re a qualifying military veteran) that requires no down payment. You can still use a temporary buydown on a VA loan, but the no down payment requirement frees up cash for renovations or other purposes.

- Leveraging an adjustable rate mortgage (ARM) instead of a fixed rate mortgage. ARMs will generally have a much lower rate, fixed rate period that can last anywhere from the first five to ten years before entering an adjusted period where the rate fluctuates based on market conditions. This can allow you to take advantage of a lower fixed rate for a longer period of time than a temporary buydown can with the hopes that you can refinance to a lower fixed rate for the remainder of the loan once the adjusted period kicks.

Summing It All Up

As you can see, a temporary buydown is just one of many lending options for you to consider for your home purchase. It’s paramount that you assemble the right team of professionals to help you navigate your particular situation. Work with your financial advisor to build an appropriate budget, set savings goals, and analyze your real estate financing and purchasing options. Also, find knowledgeable real estate and mortgage professionals that will take the time to get to know you, understand your needs and goals, and help you maximize your options.

Need help figuring out the personal and financial aspects of your home purchase? Schedule some time to chat with one of our expert advisors today to see how we can help.

Expert Sources:

Justin Milette, CEO/Realtor® at Aspire Realty Group, Anchorage, AK

Ryan Groeneweg, Mortgage Broker at Mr. Low Rates, Anchorage, AK

Forefront has no material affiliation with Aspire Realty Group or Mr. Low Rates. Forefront did not give or receive any compensation, financial or otherwise, to use these

sources. This article is intended for informational purposes only.